Professional Expenses List . updated september 28, 2023. — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. — check the list, to see if a deductions summary for your occupation or industry is available. Accountants and financial leaders can use these expenses to create a company budget, produce income statements or file tax reports. — breaking down business expenses into more specific categories, particularly within operating and non. find out which expenses you can claim as income tax deductions and work out the amount to claim. Details on claiming common teacher and education. Organizations typically accrue some costs during the course of doing business.

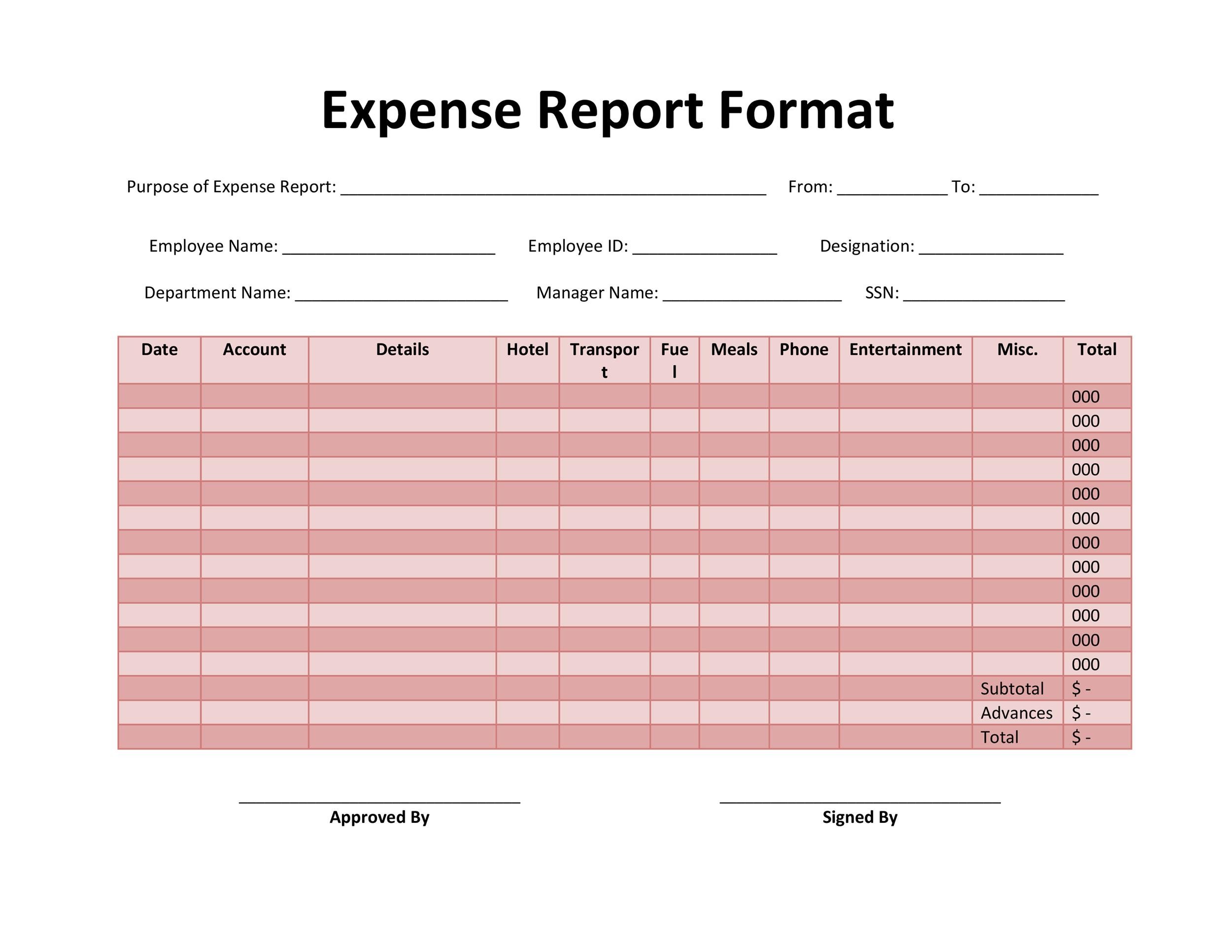

from templatelab.com

— check the list, to see if a deductions summary for your occupation or industry is available. find out which expenses you can claim as income tax deductions and work out the amount to claim. updated september 28, 2023. — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. Accountants and financial leaders can use these expenses to create a company budget, produce income statements or file tax reports. — breaking down business expenses into more specific categories, particularly within operating and non. Organizations typically accrue some costs during the course of doing business. Details on claiming common teacher and education.

40+ Expense Report Templates to Help you Save Money Template Lab

Professional Expenses List Accountants and financial leaders can use these expenses to create a company budget, produce income statements or file tax reports. Details on claiming common teacher and education. Accountants and financial leaders can use these expenses to create a company budget, produce income statements or file tax reports. — breaking down business expenses into more specific categories, particularly within operating and non. updated september 28, 2023. — check the list, to see if a deductions summary for your occupation or industry is available. — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. find out which expenses you can claim as income tax deductions and work out the amount to claim. Organizations typically accrue some costs during the course of doing business.

From dealstruck.com

The Essential Business Expenses List Common Monthly Expenses Professional Expenses List Details on claiming common teacher and education. — breaking down business expenses into more specific categories, particularly within operating and non. find out which expenses you can claim as income tax deductions and work out the amount to claim. Organizations typically accrue some costs during the course of doing business. updated september 28, 2023. — use. Professional Expenses List.

From www.excelmadeeasy.com

Excel Expense Tracking Template by Excel Made Easy Professional Expenses List find out which expenses you can claim as income tax deductions and work out the amount to claim. Organizations typically accrue some costs during the course of doing business. — check the list, to see if a deductions summary for your occupation or industry is available. Details on claiming common teacher and education. — use the professional. Professional Expenses List.

From www.smartsheet.com

Free Google Sheets Expense Report Templates Smartsheet Professional Expenses List Details on claiming common teacher and education. Organizations typically accrue some costs during the course of doing business. find out which expenses you can claim as income tax deductions and work out the amount to claim. — breaking down business expenses into more specific categories, particularly within operating and non. Accountants and financial leaders can use these expenses. Professional Expenses List.

From www.wordexcelstemplates.com

Expense List Template Free Word & Excel Templates Professional Expenses List find out which expenses you can claim as income tax deductions and work out the amount to claim. — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. Details on claiming common teacher and education. — breaking down business expenses into more specific categories, particularly within. Professional Expenses List.

From slidesdocs.com

Track Your Expenses With Credit Card Spending List Excel Template And Google Sheets File For Professional Expenses List — breaking down business expenses into more specific categories, particularly within operating and non. find out which expenses you can claim as income tax deductions and work out the amount to claim. Details on claiming common teacher and education. updated september 28, 2023. Accountants and financial leaders can use these expenses to create a company budget, produce. Professional Expenses List.

From www.pdffiller.com

Fillable Online Tech Professionals Expense List Fax Email Print pdfFiller Professional Expenses List find out which expenses you can claim as income tax deductions and work out the amount to claim. — check the list, to see if a deductions summary for your occupation or industry is available. — breaking down business expenses into more specific categories, particularly within operating and non. Organizations typically accrue some costs during the course. Professional Expenses List.

From templatearchive.com

30 Effective Monthly Expenses Templates (& Bill Trackers) Professional Expenses List — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. — check the list, to see if a deductions summary for your occupation or industry is available. Organizations typically accrue some costs during the course of doing business. find out which expenses you can claim as. Professional Expenses List.

From www.sampletemplates.com

FREE 10+ Sample Lists of Expense in MS Word PDF Professional Expenses List updated september 28, 2023. find out which expenses you can claim as income tax deductions and work out the amount to claim. Details on claiming common teacher and education. — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. Organizations typically accrue some costs during the. Professional Expenses List.

From templatelab.com

40+ Expense Report Templates to Help you Save Money Template Lab Professional Expenses List Details on claiming common teacher and education. find out which expenses you can claim as income tax deductions and work out the amount to claim. — breaking down business expenses into more specific categories, particularly within operating and non. Accountants and financial leaders can use these expenses to create a company budget, produce income statements or file tax. Professional Expenses List.

From www.wordexcelstemplates.com

Expense List Template Free Word & Excel Templates Professional Expenses List Details on claiming common teacher and education. — breaking down business expenses into more specific categories, particularly within operating and non. Accountants and financial leaders can use these expenses to create a company budget, produce income statements or file tax reports. — check the list, to see if a deductions summary for your occupation or industry is available.. Professional Expenses List.

From excelxo.com

Business Expenses Template — Professional Expenses List find out which expenses you can claim as income tax deductions and work out the amount to claim. — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. Organizations typically accrue some costs during the course of doing business. — check the list, to see if. Professional Expenses List.

From adeline-jolpblogrivas.blogspot.com

List of Expenses in Accounting Professional Expenses List find out which expenses you can claim as income tax deductions and work out the amount to claim. Organizations typically accrue some costs during the course of doing business. Details on claiming common teacher and education. — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. . Professional Expenses List.

From www.wordexcelstemplates.com

Expense List Template Free Word & Excel Templates Professional Expenses List — breaking down business expenses into more specific categories, particularly within operating and non. find out which expenses you can claim as income tax deductions and work out the amount to claim. Accountants and financial leaders can use these expenses to create a company budget, produce income statements or file tax reports. updated september 28, 2023. . Professional Expenses List.

From myexceltemplates.com

Tech Professionals Expense List Invoice and Budget Template Professional Expenses List — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. — breaking down business expenses into more specific categories, particularly within operating and non. Organizations typically accrue some costs during the course of doing business. find out which expenses you can claim as income tax deductions. Professional Expenses List.

From www.wordexcelstemplates.com

Daily Cash Expenses Sheet Template Free Word & Excel Templates Professional Expenses List Organizations typically accrue some costs during the course of doing business. — breaking down business expenses into more specific categories, particularly within operating and non. Details on claiming common teacher and education. updated september 28, 2023. find out which expenses you can claim as income tax deductions and work out the amount to claim. — check. Professional Expenses List.

From www.smartsheet.com

Free Expense Report Templates Smartsheet Professional Expenses List — use the professional expenses category for the money you spend on professional and advisory services, such as when you hire. Details on claiming common teacher and education. updated september 28, 2023. find out which expenses you can claim as income tax deductions and work out the amount to claim. — breaking down business expenses into. Professional Expenses List.

From templatearchive.com

30 Effective Monthly Expenses Templates (& Bill Trackers) Professional Expenses List Details on claiming common teacher and education. Organizations typically accrue some costs during the course of doing business. — breaking down business expenses into more specific categories, particularly within operating and non. find out which expenses you can claim as income tax deductions and work out the amount to claim. — check the list, to see if. Professional Expenses List.

From template.ourinsurance.web.id

Business Expense Spreadsheet Template Excel And Daily with regard to Expense Report Spreadsheet Professional Expenses List find out which expenses you can claim as income tax deductions and work out the amount to claim. updated september 28, 2023. Accountants and financial leaders can use these expenses to create a company budget, produce income statements or file tax reports. Organizations typically accrue some costs during the course of doing business. — check the list,. Professional Expenses List.